|

| Digital Brands Group has changed the traditional nature of the corporate holding company structure for direct to consumer and wholesale apparel brands by focusing on a customer’s "closet share" and leveraging their data and personalized customer cohorts to create targeted content. We believe this allows the company to successfully drive LTV while increasing new customer growth. Furthermore, Digital Brands Group strives to drives margin expansion through a shared services model and by owning the entire margin stack, which allows the company the ability to control pricing, promotions and proftability. This creates a scalable fywheel driven by personalized and targeted customer experiences, which we believe fuels loyalty, LTV and virality that leverages operating costs with the goal of increasing cash fow. 2 x Reshaping Traditional Retail |

| 3 We believe that traditional department and specialty stores are no longer able to leverage their dominant power to determine brand product assortments, price points and promotional activity as they no longer maintain exclusivity on the customer relationship. We believe that customer transactions have transitioned to the internet as digital distribution continues to capture greater wallet-share, crushing traditional operating margins and forcing unprecedented store closures. However, we believe that digitally native brands are not a stand-alone business because they are not scalable, proftable and therefore unsustainable. Digital is a channel not a business model. We believe that the digital-only model fails because it strugles to acquire customers at a fair price and grow market share while achieving proftability as shopping, returns, marketing and hiring expenses outstrip repeat customer revenue. x CURRENT RETAIL ISSUES Our Belief is That Traditional Retail is Broken & Digital-Only Brands Can Not Scale to Sustainability |

| Modernizing the Holding Company Model by Owning Multiple Brands Our growth model focuses on driving significant revenue growth over a lower shared cost base, creating margin expansion, resulting in increased cash flow. 4 PORTFOLIO OF BRANDS CLOSET SHARE CUSTOMER DATA CUSTOMIZED CONTENT OWNING THE MARGIN STACK CASH FLOW CONTROL COST SYNERGIES MARGIN EXPANSION = = = = 1 2 3 4 HOW WE WIN |

| Very seldom does one wear the same brand from head to toe. By owning multiple brands across complementary categories, the customer is provided head to toe looks and personalized styles. This results in the customer buying and wearing multiple brands, across product categories instead of wearing a singular brand’s products in one category. Digital Brands Group refers to this as “Closet Share,” which results in best of class KPIs, margins and sustainable revenue growth. By owning the customer data, Digital Brands Group is able to capture an individual’s shopping behavior and style preferences. This results in the ability to cross merchandise styles for every customer using all the brands in the portfolio to create personalized looks for each customer. Digital Brands Group refers to this as "Customized Content" for each customer. This content is highly targeted, and as they aggregate more data, it exponentially increases the customers in their audience build, whereby customer cohorts become increasingly targeted and customized. 5 PORTFOLIO OF BRANDS CLOSET SHARE CUSTOMER DATA CUSTOMIZED CONTENT = = Modernizing the Holding Company Model HOW WE WIN Driving Significant Revenue Growth |

| Capitalizing on the Changing Retail Landscape Our growth model focuses on our formula for Sustainable Success: Acquire in Physical, Retain in Digital Traditional B&M For single-brand physical stores, we believe this is not a scalable solution. Many of these stores are unproftable and require balance sheet obligations. For single-brands that rely on department stores to generate their revenue, we believe the gross margins continuously diminishes due to signifcant mark-downs and returns demanded by the department stores. Traditional DTC We believe this is not a scalable solution since customers acquired online have a low loyalty rate, and also have very high return rates. We believe this means the brands spend significant CAC dollars on a low retention customer with high returns. We believe this results in low margins and significant cap ex. New Formula: Acquire Physical/Retain Digital It is not about being an omni channel brand, it is about where you acquire and retain the customer. By using wholesale channels for acquisition, our brands have low CAC, solid gross margins and significant distribution and reach since this is a limited revenue channel. The customer can see, feel and fit the product, which we believe lowers returns when they acquire online. By using digital channels for retention, our brands create personalized content using all our brands to show different looks that are created using their shopping data. Our brands have high gross margins, low CAC, high retention due to personalized communications, and control over the frequency and content of the customer communications. PURCHASE $$$ PRE-PURCHASE POST-PURCHASE BRICK & MORTAR PURCHASE PRE-PURCHASE $$$ POST-PURCHASE DTC OMNI-CHANNEL PURCHASE $ PRE-PURCHASE $ POST-PURCHASE $ POST-COVID We believe the wholesale and DTC strategies above force brands to heavy up all their marketing spend in one area of the customer's path to purchase. Our formula is designed to spread those same dollars over each area, which we believe creates lower CAC and return rates and higher gross margins and retention rates. 6 HOW WE WIN PRE-COVID PRE-COVID |

| 7 Modernizing the Holding Company Model Jane Jacket 400% increase in units sold Merchandised with a DSTLD denim skirt Claudine Pant 71% increase in units sold Merchandised with DSTLD leather hoodie Case study: Cross-Merchandising Our Portfolio Brands Drives Results DSTLD separates merchandised with Bailey 44 product on bailey44.com increased sales of the Bailey’s collection 7 HOW WE WIN |

| 8 Modernizing the Holding Company Model DSTLD Denim Skirt 500% increase in units sold DSTLD Leather Hoodie 600% increase in units sold Case study: Cross Merchandising Increases Portfolio Results & Significantly Decreases CAC Costs DSTLD products featured for sale on bailey44.com increased DSTLD sales and there was no CAC to acquire the customer 8 HOW WE WIN |

| Modernizing the Holding Company Model Our Marketing Team Applied Our Best Practices to Bailey's Acquisition New Photography, Styling and Customer Communications Created an Immediate Lift in Product Sales Addie Polka Dot Sweater 225% Increase in Units Sold Weldon Belted Jacket From 0 units to 22 units in 3 weeks Dishdasha Dress 176% Increase in Units Sold Lizzie Crop Pant 200% Increase in Units Sold Kendra Bodysuit 140% Increase in Units Sold Elize Cami 120% Increase in Units Sold Mini Marguerite Top 400% Increase in Units Sold 9 HOW WE WIN |

| By owning the supply chain and margin stack, the group controls the retail price points, the promotional activities, and the gross/ operating margins. This results in (1) lower price points for the customer, which increases sell-through and revenues, and (2) higher gross/operating margins as they control the retail price points, promotions and margin structure, with the goal of increasing cash flow. Digital Brands Group refers to this as "Cash Flow Control," providing them the power to set their own retail price points, margin structure, and promotional activities resulting in higher margins, sustainable cash flow and operating leverage. By owning multiple brands, Digital Brands Group leverages fixed and variable costs across multiple revenue streams through shared services. This results in marketing, back office, and fulfillment efficiencies across multiple brands while allowing them to hire experienced leaders at the portfolio level, sharing their expertise across the entire company. Digital Brands Group refers to this as "Margin Expansion," providing each brand with lower operating expenses and the portfolio company with significantly higher operating margins and cash flow. Moreover, this allows for the creation of “Best in Class” management bench strength. 10 OWNING THE MARGIN STACK CASH FLOW CONTROL COST SYNERGIES MARGIN EXPANSION = = Modernizing the Holding Company Model HOW WE WIN Lower cost base creates increased cash flow |

| Driven by Wall Street Ready Management Team Hil Davis CHIEF EXECUTIVE OFFICER Reid Yeoman CHIEF FINANCIAL OFFICER John Hilburn Davis IV, ''Hil", has served as our President and Chief Executive Offcer since March 2019. He joined DSLTD to overhaul its supply chain in March 2018. Prior to that, Mr. Davis founded two companies, Beauty Kind and J.Hilburn. He founded and was CEO of BeautyKind from October 2013 to January 2018. He also founded and was CEO of J.Hilburn from January 2007 to September 2013, growing it from $0 to $55 million in revenues in six years. From 1998 to 2006 Mr. Davis worked as an equity research analyst covering consumer luxury publicly traded companies at Thomas Weisel Partners, SunTrust Robinson Humphrey and Citadel Investment Group. He graduated from Rhodes College in 1995 with a BA in Sociology and Anthropology. Reid Yeoman has served as our Chief Financial Officer since October 2019. Mr. Yeoman is a finance professional with a core Financial Planning & Analysis background at major multi-national Fortune 500 companies - including Nike & Qualcomm. He has a proven track record of driving growth and expanding profitability with retail. From November 2017 to September 2019, Mr. Yeoman served as CFO/ COO at Hurley - a standalone global brand within the Nike portfolio - where he managed the full profit and loss/Balance Sheet, reporting directly to Nike and oversaw the brand's logistics and operations. He is a native Californian and graduated with an MBA from UCLA's Anderson School of Management in 2013 and a BA from UC Santa Barbara in 2004. Laura Dowling CHIEF MARKETING OFFICER Laura Dowling has served as our Chief Marketing Offcer since February 2019. Prior to that she was the Divisional Vice President of Marketing & PR, North America at Coach from February 2016 to August 2018. At Coach Ms. Dowling led a team of 25 and was held accountable for $45 million proft and loss. From August 2011 to February 2016, she was the Director of Marketing & PR at Harry Winston and from March 2009 to August 2011 she was the Director of Wholesale Marketing at Ralph Lauren. Ms. Dowling holds both a Masters degree (2002) and Bachelors degree (2001) in Communications & Media Studies with a Minor in French from Fordham University. Jon Patrick MENS DESIGN DIRECTOR JP joined in December 2019 with an extensive background In apparel design, merchandising, VM presentation, retail development, and commerce which began at Ralph Lauren where he was then recruited by Hart Schaffner Marx to lead design and merchandising to develop and grow a captured brand strategy— pairing licensed brands with exclusive retail partners. Then moved into Womenswear with Lilly Pulitzer, where he spearheaded store design, retail development, and established corporate standards for company stores and franchises to scale successfully. He most recently worked with the founders of UNTUCKit to transition the brand from an Ecommerce retailer to a click & mortar kingpin, operation over 70+ stores for them. Lisa Kulson WOMENS DESIGN DIRECTOR Recently joined DBG as the Women’s Design Director and will lead the transformation of the women’s contemporary label Bailey 44 with new capsule collection launching this Fall. A member of the CFDA since 2016, Kulson is well-known for her time at Theory as Creative Director and SVP of Design. She was there at the brand’s inception in 1997 then left to create her own label and returned in 2003 to creatively consult while simultaneously aiding in the launch of the contemporary “H” by Tommy Hilfger collection. Lisa designs clothing for modern women who prioritize effortless dressing and living an inspired, global lifestyle. Rather than following fast fashion trends, she focuses on creating sophisticated, aspirational clothes that stand the test of time. 11 DBG VISION |

| New Board Nominees Moise Emquies EXECUTIVE BOARD MEMBER Moise Emquies is the Founder and Creative Director of Stateside, a line of premium basics for women. The clothing collection focuses on quality, comfort, and ethical manufacturing in Los Angeles. Moise is also an Advisor and Partner at the contemporary women’s brand Sundry. Other current projects include overseeing a large portfolio of consumer brand investments such as Glossier, Frame Denim, Good American, Skims, Reformation, Aviation Gin and Amass. He is also the President of Mo Ventures, a commercial real estate development company in Los Angeles that focuses on creative offce space and luxury retail. Previously, Moise was the Founder and Creative Director of the clothing brands Splendid and Ella Moss which were acquired by VF Corporation in 2009. Moise holds a BA from the University of Southern California and a JD from Southwestern Law School. He sits on the Board of Governors at Cedars Sinai Hospital in Los Angeles. Jameeka Green Aaron EXECUTIVE BOARD MEMBER Jameeka Green Aaron is the Chief Information Security Offcer at Auth0, she is responsible for the holistic security and compliance of Auth0’s platform, products, and corporate environment. Auth0 provides a platform to authenticate, authorize, and secure access for applications, devices, and users. Prior to her current role Jameeka was the Chief Information Offcer Westcoast Operations at United Legwear and Apparel. Her 20+ years of experience include serving as the Director of North American Technology and Director of Secure Code and Identity and Access Management at Nike, and as Chief of Staff to the CIO of Lockheed Martin Space Systems Company. She is also a 9-year veteran of the United States Navy. Jameeka’s dedication to service has extended beyond her military career; She is committed to advancing women and people of color in Science, Technology, Engineering, and Mathematics (STEM) felds she is an alumni of the U.S. State Department’s TechWomen program and the National Urban League of Young Professionals. She currently sits on the board of the California Women Veterans Leadership Council, is an advisor for U.C. Riverside Design Thinking Program, and is a member of Alpha Kappa Alpha Sorority, Inc. Born in Stockton, California, she holds a bachelor’s degree in Information Technology from the University of Massachusetts, Lowell. She is an ISC (2) Certifed Information Systems Security Professional (CISSP 12 DBG VISION |

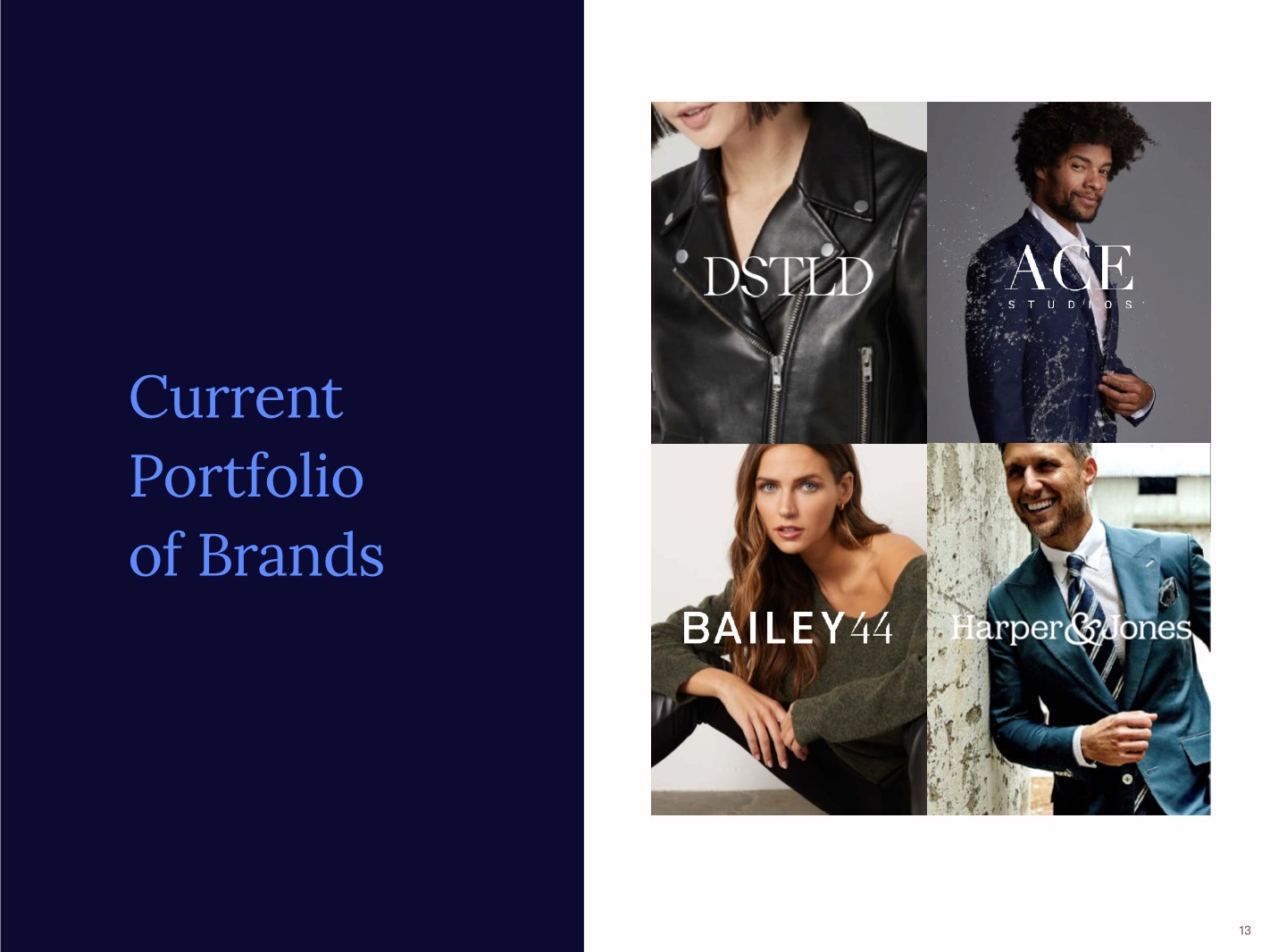

| Current Portfolio of Brands 13 |

| 14 14 • Focused on classic design, superior quality, and essential product selection in order to deliver the perfect core wardrobe. • Inspired by a sophisticated, modern and sleek style utilizing an edited color palette. • Creative and urban, city dwellers within the coveted age demographic of 25–35. The Purpose |

| 15 • Offers premium suiting and sportswear at an exceptional value. Constructed from luxury fabrics and designed in multiple fts, to create a more custom-tailored look as all men are built differently. • Partnering with the mills and factories in Italy and Europe, the collection is driven by luxury, performance, ft and quality. • A customer target base of men ages 18–45 looking to invest in quality suiting and sportswear at more accessible prices. 15 The Purpose |

| 16 • A contemporary womenswear brand that combines beautiful, luxe fabrics with on-trend designs specializing in the “date night” category. • Majority of distribution through specialty and select wholesale partners such as Nordstrom and Bloomingdales. • Our most well-known brand and widest distribution that we intend to leverage across other brands. 16 The Purpose |

| 17 17 • Tastemaker stylish “made-to-measure” suiting and sportswear that relays a one-of-a-kind confdence. • Ability to provide full-closet customization, including shirts, jackets, pants, shorts, polos, and more that are all made-to-measure. • Ready-to-Wear is an expanding category for the brand and our goal is that it will increase the addressable market The Purpose |